USA Credit Card Interest Rates

| Provider | Rate | Type | Updated | |

|---|---|---|---|---|

|

USAA Rate Advantage Visa Platinum Card Same Rate on Purchases, Cash and Transfers |

1.40% to 28.40% | - | Mar 2023 |

|

Navy Federal Credit Union Platinum Credit Card Rate indicated is based on the Platinum credit card product and has a variable APR based upon creditworthiness and has no annual fee. |

8.24% - 18.00% | - | Aug 2019 |

|

Star One Credit Union Visa Platinum Best Rate Credit Card Rate indicated is based on the VISA Platinum Best Rate Card product with no annual fee |

8.75%-12.75% | - | Aug 2019 |

|

BECU Visa Credit Card It offers no annual fee and your rate depends on your creditworthiness |

9.15% | - | Aug 2019 |

|

Security Service Power MasterCard Credit Card Rate indicated is based on the Security Services Power MasterCard product and has a variable purchase APR depending on creditworthiness. |

9.49% - 18.00% | - | Aug 2019 |

|

SECU Visa Credit Card Rate indicated is based on the Visa Credit Card product with no annual fee |

9.75% | - | Aug 2019 |

|

Golden 1 Credit Union Platinum Rewards Credit Card Rate indicated is based on the Platinum Rewards Visa product. This card has no annual fee. Offers cash rebates on gas, grocery and restaurant purchases. More details from their website. |

9.79% to 15.79% | - | Aug 2019 |

|

SDCCU Visa Platinum Credit Card Rate indicated is based on the Visa Credit Card product and has a non-variable APR for purchases |

9.99%, 12.99%, 14.99%, or 19.99% | - | Feb 2020 |

|

SchoolsFirst Inspire Credit Card Rate indicated is based on the Inspire MasterCard Schoolsfirst CU product with no annual fee. |

10.00% - 17.90% | - | Feb 2020 |

|

Union Bank Visa Credit Card Rate indicated is based on the Union Bank Platinum Edition Visa Card product and has $0 annual fee |

10.74% to 22.24% | - | Aug 2019 |

In the United States in regards to credit cards and their associated rates, banks may use a credit scoring as a factor to help determine whether to give a person credit.The legislated Fair Credit Reporting Act (FCRA) gives someone the right to get their credit score from the national credit reporting companies.

FICO Score and Credit Cards

Many lenders and credit card issuers use a FICO score or variation credit score, which is typically a three-digit number that is used as an indicator about the credit worthiness of the customer, that is how likely you are to repay them if they grant you a credit card. Sometimes this score could also be used to set the interest rate you’ll pay for mortgages as well.

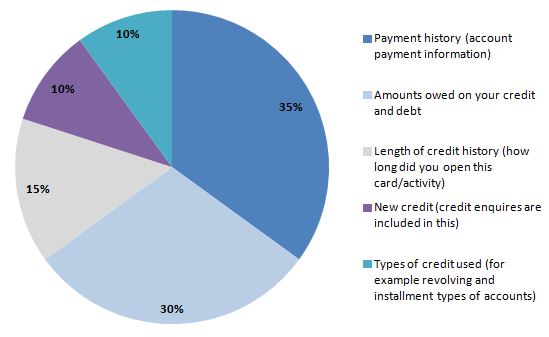

What does a FICO score comprise of?